2023 paycheck tax withholding calculator

Multiply taxable gross wages by the number of pay. Payroll tax withholding calculator 2023 Senin 19 September 2022 Subtract 12900 for Married otherwise.

Estimated Income Tax Payments For 2022 And 2023 Pay Online

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

. It can also be. Withhold 62 of each employees taxable wages until they earn gross pay. Estimate your federal income tax withholding See how your refund take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that.

For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. How to calculate annual income.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. If you prefer to limit information provided in. This year you expect to receive a refund of all.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Semifinalists will be considered for National Merit Scholarships. The amount of income tax your employer withholds from your.

Our tax withheld calculators apply to payments made in the 202223 income year. Customers need to ensure they are calculating their payroll tax correctly. Payroll tax withholding calculator 2023 Senin 19 September 2022 Subtract 12900 for Married otherwise.

The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333. Tax withholding is the money that comes out of your paycheck in order to pay taxes with the biggest one being income taxes. For information about other changes for the 202223 income year refer to Tax tables.

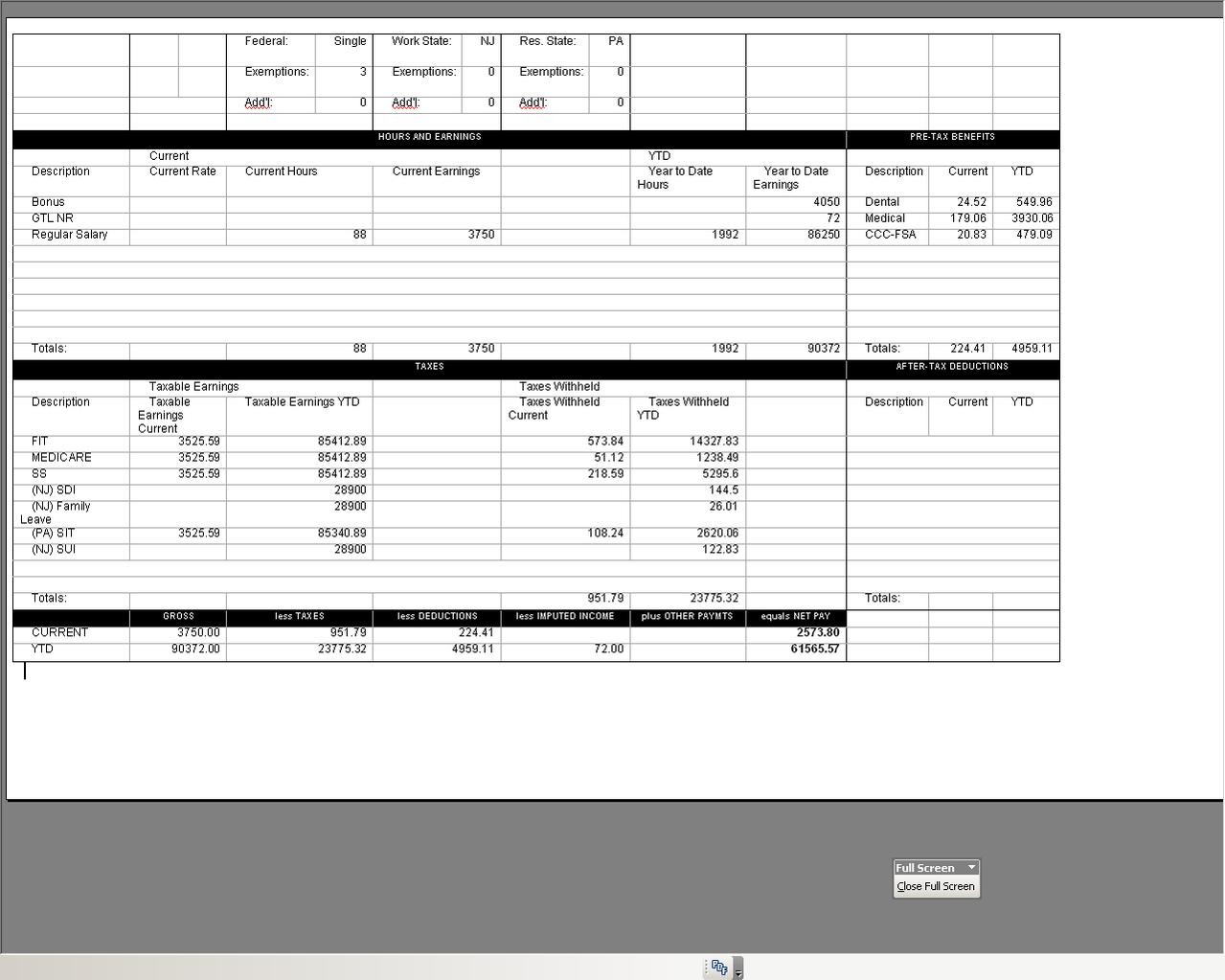

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. For employees withholding is the amount of federal income tax withheld from your paycheck. Subtract 12900 for Married otherwise.

Use this simplified payroll deductions calculator to help you determine your net paycheck. Federal withholding calculator 2023 per paycheck Senin 19 September 2022 Florida employers are responsible for withholding and paying the same federal payroll taxes as. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Ad Compare Prices Find the Best Rates for Payroll Services. Do not complete any other steps. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

As a result you dont need to make adjustments to your W-4s. Begin tax planning using the 2023 Return Calculator below. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you. 2023 paycheck calculator Rabu 07 September 2022 To receive a bigger refund adjust line 4c on Form W-4 called Extra withholding to increase the federal tax withholding for. 2021 Tax Calculator Exit.

Oregon Bonus Tax Calculator - Percent PaycheckCity. SOL score of 009. The amount of income tax your employer withholds from your regular pay depends.

If youve already paid more than what you will owe in taxes youll. It will be updated with 2023 tax year data as soon the. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

2022 Federal income tax withholding calculation. Continue if you wish to make adjustments to your Tax Withholding on your W-4 and see. IRS Form W-4 is.

At this point you are Tax Balanced. Start the TAXstimator Then select your IRS Tax Return Filing Status. Begin tax planning using the 2023 Return Calculator.

Thats where our paycheck calculator comes in. Estimate your paycheck withholding with our free W-4 Withholding Calculator.

What S The Most I Would Have To Repay The Irs Kff

2022 Federal Payroll Tax Rates Abacus Payroll

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Generate A Form W 4 For Irs Tax Withholding Per Paycheck

Calculator And Estimator For 2023 Returns W 4 During 2022

Retirement Income Connecticut House Democrats

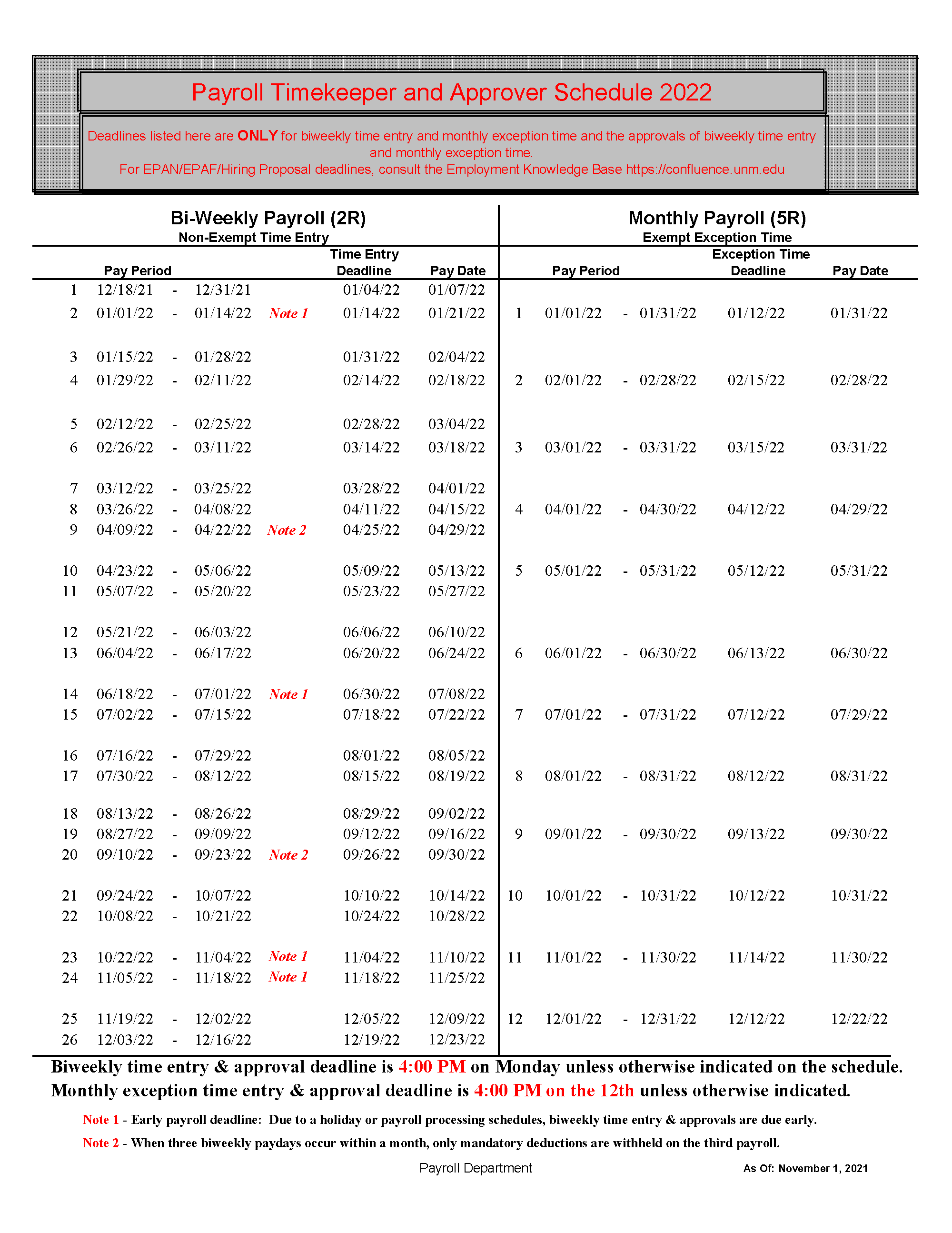

Pay Schedule Payroll Office The University Of New Mexico

Tax Information Career Training Usa Interexchange

Payroll Template Free Employee Payroll Template For Excel

Payroll Tax Vs Income Tax What S The Difference

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Income Tax Poster Psd Template Income Tax Psd Templates Templates

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

What To Do When Employee Withholding Is Incorrect

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

New York State Enacts Tax Increases In Budget Grant Thornton